Overview

- Updated On:

- June 11, 2025

Property Description

2025 Real Estate Tax Relief in Pakistan – Big News for Buyers & Investors

Property Express – Your Lifetime Real Estate Agency

The Government of Pakistan has announced a historic tax relief package for the real estate sector in 2025. This initiative is aimed at revitalizing the property market, encouraging genuine buyers, and boosting investment in housing and construction. At Property Express, we bring you a complete breakdown of these changes and what they mean for you as a buyer, seller, or investor.

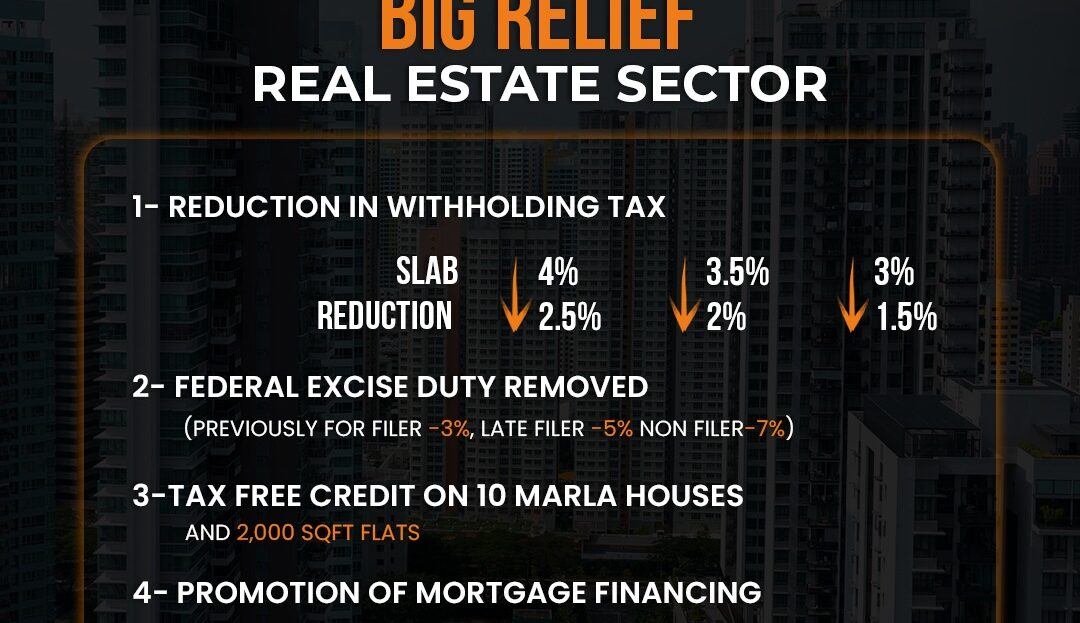

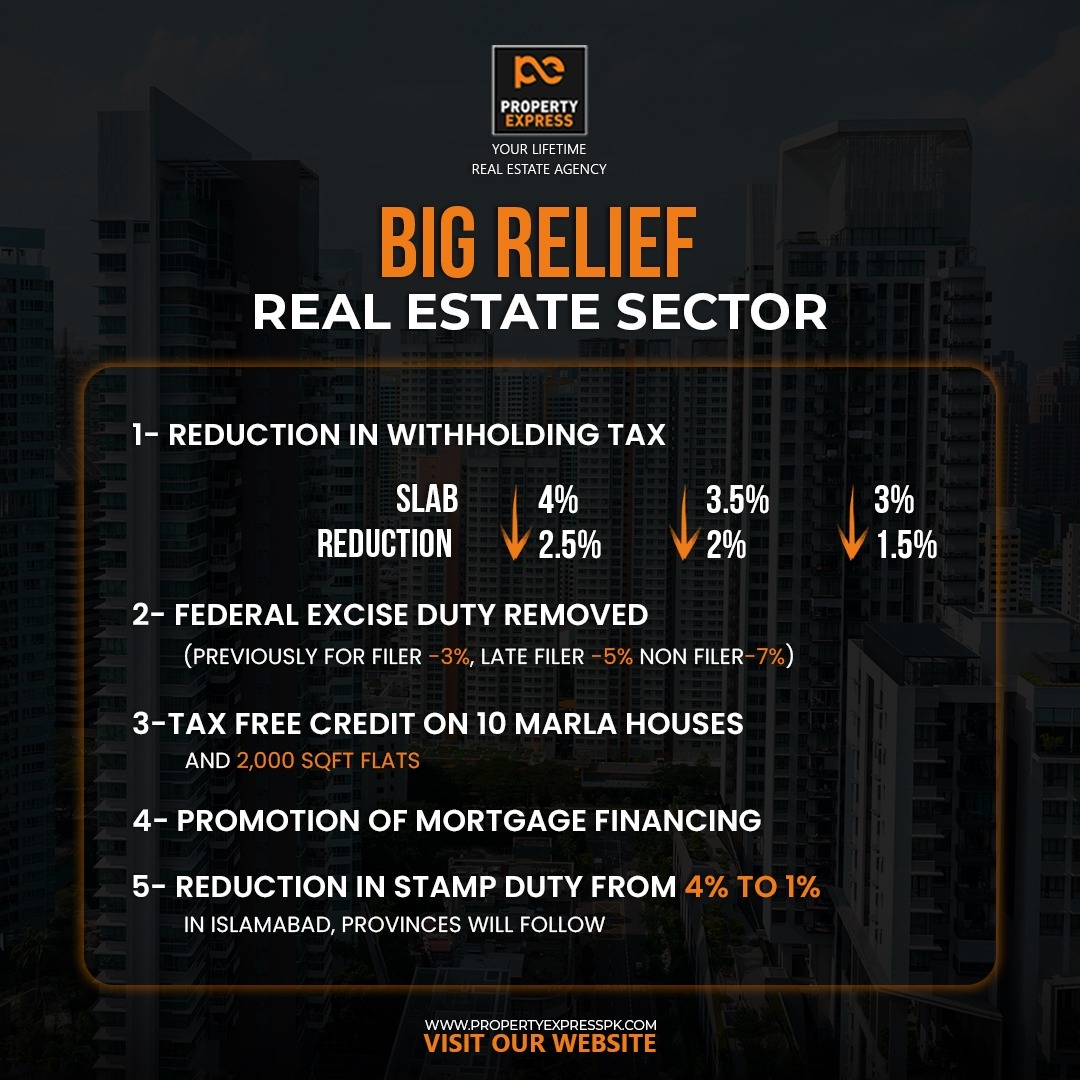

1. Major Reduction in Withholding Tax – Now as Low as 1.5%

One of the most impactful changes is the significant reduction in withholding tax slabs on property transactions. This tax, previously a major burden on real estate deals, has now been simplified and lowered:

-

Previous Rate: Up to 4%

-

New Slabs:

-

2.5%

-

3.5%

-

3%

-

2%

-

1.5% (lowest)

-

This reduction means more savings on every transaction, especially for those purchasing larger or higher-value properties.

2. Complete Removal of Federal Excise Duty (FED)

Previously, Federal Excise Duty was charged on the sale and transfer of properties:

-

3% for filers

-

5% for late filers

-

7% for non-filers

In 2025, FED has been entirely removed, making property transactions more affordable across the board and reducing the documentation and financial burden on genuine investors and end-users.

3. Tax-Free Credit for 10 Marla Houses and 2,000 Sq. Ft. Flats

Another game-changing incentive is the tax-free credit facility now available for:

-

10 Marla residential houses

-

2,000 square foot flats

This policy promotes affordable housing and enables middle-income families to benefit from government-backed financial incentives, reducing the overall cost of homeownership.

4. Promotion of Mortgage Financing

The government has emphasized the promotion of mortgage and home financing through public-private partnerships and regulatory reforms. Easier access to bank financing, reduced interest rates, and flexible loan terms are expected to increase housing affordability and stimulate demand in the real estate market.

5. Stamp Duty Reduced from 4% to 1% in Islamabad

In a bold move to lower transaction costs, stamp duty in Islamabad has been reduced from 4% to just 1%. This will:

-

Encourage documented transactions

-

Increase formal registrations

-

Attract first-time buyers and overseas Pakistanis

Provincial governments are expected to follow this lead, further reducing the burden on property buyers across Punjab, Sindh, KPK, and Balochistan.

Why This Matters for You

Whether you’re planning to buy a home, invest in commercial property, or build long-term assets, the 2025 tax relief package offers real benefits:

-

Lower transaction costs

-

Higher affordability

-

Increased investment returns

-

Boost in mortgage approvals

-

Stronger and more transparent property documentation

Partner with Property Express

As a leading real estate agency, Property Express is committed to helping you make informed, profitable decisions. With expert consultants, up-to-date listings, and end-to-end support, we are here to guide you through this new, buyer-friendly landscape.

Contact us today to explore the best property opportunities and take advantage of the new tax incentives for 2025.